Agreement to provide insurance form PDF: A detailed guide to understanding, creating, and using these crucial documents. This covers everything from the structure and content to legal considerations, data privacy, and practical applications. We’ll delve into the intricacies of these forms, exploring best practices and offering real-world examples.

This guide dissects the various aspects of an agreement to provide insurance form, including legal ramifications, data protection, and practical applications. It aims to provide a clear understanding of this critical document type.

Form Structure and Content: Agreement To Provide Insurance Form Pdf

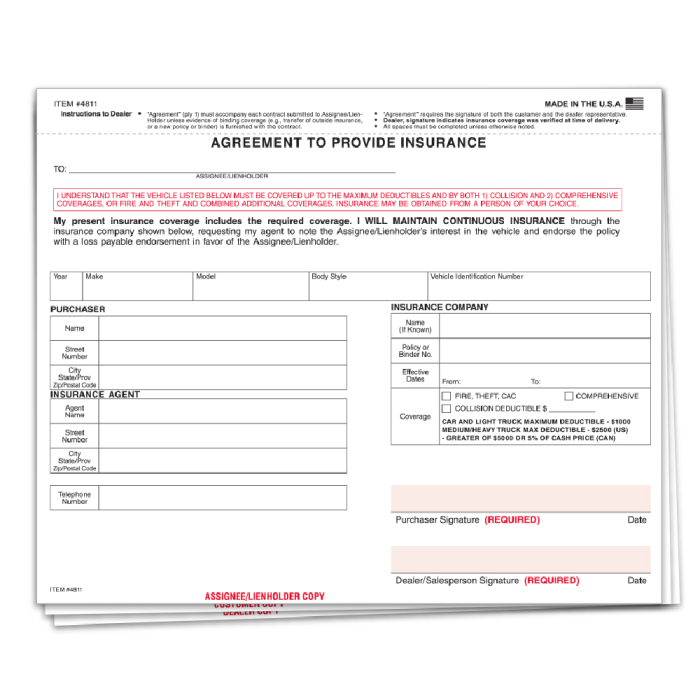

An agreement to provide insurance form Artikels the terms and conditions under which an insurance provider agrees to cover specific risks for an individual or entity. This document is crucial for establishing the contractual obligations of both parties, ensuring clarity and minimizing potential disputes. It acts as a legally binding agreement, formalizing the insurance coverage and expectations.

Typical Sections of an Insurance Agreement Form

This form typically includes several key sections, each designed to capture critical information and define the scope of coverage. A well-structured form streamlines the process, reducing the likelihood of errors and misunderstandings.

| Section Name | Description | Required Information |

|---|---|---|

| Personal Information | Identifies the policyholder and insured parties. | Full name, address, date of birth, contact information, policy number (if applicable), details of any existing insurance, and potentially employment information. |

| Insurance Details | Specifies the type of insurance, coverage limits, and the perils covered. | Type of insurance (e.g., health, life, auto), specific coverages (e.g., hospitalization, accidental death), policy limits, deductible amount, and premium payment schedule. |

| Agreement Terms | Artikels the rights and responsibilities of both parties, including policy conditions, exclusions, and dispute resolution procedures. | Policy conditions (e.g., waiting periods, claim procedures), exclusions (e.g., pre-existing conditions, certain activities), and clauses regarding termination or amendment of the agreement. |

| Premium Payment Information | Details the method and schedule of premium payments. | Payment frequency, due dates, acceptable payment methods (e.g., check, credit card), and late payment penalties (if applicable). |

| Endorsements and Addendums | Provides a space for additions or modifications to the base agreement. | Any additional coverage, riders, or amendments to the original agreement. |

| Signatures and Dates | Confirms the agreement’s validity. | Signatures of authorized representatives from both the policyholder and the insurance provider, along with the date of signing. |

Comparison with Other Insurance Agreements

Different types of insurance agreements, while sharing common elements, can vary significantly in their structure and content. This table illustrates the contrasting aspects.

| Section | Health Insurance Agreement | Life Insurance Agreement | Auto Insurance Agreement |

|---|---|---|---|

| Personal Information | Emphasis on health history and pre-existing conditions. | Focus on age, health, and lifestyle factors. | Details of the vehicle, driver information, and driving history. |

| Insurance Details | Coverage for medical expenses, hospitalization, and rehabilitation. | Death benefit amounts, coverage duration, and beneficiary details. | Coverage for accidents, damage, and liability. |

| Agreement Terms | Conditions for coverage, claim procedures, and waiting periods. | Policy term, payment schedules, and termination clauses. | Policy term, accident reporting procedures, and liability limits. |

Legal Considerations

An agreement to provide insurance, while seemingly straightforward, carries significant legal implications. Carefully drafted clauses are crucial to prevent future disputes and ensure the agreement’s enforceability. Understanding these implications is essential for both the insurer and the insured to protect their respective interests.

Clarity and Accuracy in Wording

Precise and unambiguous language is paramount in insurance agreements. Vague or ambiguous wording can lead to misinterpretations and legal challenges. Clear definitions of terms, such as coverage limits, exclusions, and policy durations, are essential to avoid misunderstandings. Using standardized legal terminology and avoiding colloquialisms further enhances clarity and reduces the risk of misinterpretation. For example, the term “accident” should be defined precisely to delineate the scope of coverage.

Potential Legal Pitfalls and Preventative Measures, Agreement to provide insurance form pdf

Ambiguity or omissions in the agreement can create significant legal problems. A poorly worded clause concerning policy cancellation, for example, could expose the insurer to substantial liability if the process is unclear. Unclear definitions of “material misrepresentation” could lead to disputes over the validity of the agreement. Likewise, failure to adequately address the issue of policy renewal could result in unforeseen complications.

Table of Potential Legal Pitfalls and Preventative Measures

| Potential Legal Pitfall | Preventative Measures |

|---|---|

| Ambiguous coverage definitions | Provide clear and concise definitions of all key terms, using industry-standard terminology where appropriate. Include specific examples to illustrate the scope of coverage. |

| Omissions in policy cancellation procedures | Detail the precise process for policy cancellation, including notice requirements, fees, and potential penalties. Consider consulting with legal counsel to ensure compliance with applicable regulations. |

| Lack of clarity on renewal terms | Clearly Artikel the conditions for policy renewal, including the required notice period and any associated fees or changes to premiums. Address situations where renewal is automatically declined or requires specific action by the insured. |

| Failure to address material misrepresentation | Include a comprehensive clause defining material misrepresentation and its consequences. Ensure the definition is aligned with relevant legal standards. |

| Unclear dispute resolution mechanisms | Specify a clear process for resolving disputes, including arbitration or mediation options. This can help to expedite the resolution process and avoid protracted legal battles. |

Data Privacy and Security

Protecting the personal information of policyholders is paramount. This section Artikels the crucial data privacy regulations and security measures to be implemented within the insurance agreement form. Adherence to these standards ensures compliance and builds trust.Data privacy regulations, such as the General Data Protection Regulation (GDPR), significantly impact how personal information is collected and handled. These regulations require organizations to obtain explicit consent for data collection, maintain the confidentiality and integrity of data, and ensure transparency regarding data usage.

These principles extend beyond the scope of the form and encompass all related processes.

Data Privacy Regulations Summary

Data privacy regulations, such as GDPR, mandate that personal information be processed lawfully, fairly, and transparently. This includes obtaining explicit consent for data collection, minimizing data collection to what is necessary, and ensuring data accuracy and storage limitations. These regulations apply to all parties involved in handling the form and related data.

Data Security Best Practices

Robust data security practices are essential to protect sensitive information. These practices include implementing encryption, access controls, and regular security audits. Strong passwords, multi-factor authentication, and secure data storage are vital elements of a comprehensive data security plan.

Incorporating Security Measures in Form Design and Procedures

The design and procedures of the insurance agreement form should reflect a commitment to data security. This involves utilizing encryption for data transmission and storage, implementing access controls to restrict data access to authorized personnel, and implementing regular security audits. This integrated approach ensures compliance and safeguards against unauthorized access or misuse of data.

Security Protocols and Implementation

- Encryption: All sensitive data fields within the form should be encrypted both during transmission and storage. This includes using strong encryption algorithms to protect data from unauthorized access, such as using Transport Layer Security (TLS) protocols for online forms.

- Access Controls: Implement strict access controls to restrict data access to authorized personnel. This involves defining roles and responsibilities and implementing user authentication and authorization mechanisms to prevent unauthorized access.

- Regular Security Audits: Regular security audits should be conducted to identify and address vulnerabilities. These audits should assess the effectiveness of implemented security measures and identify potential weaknesses in the system.

- Data Minimization: Collect only the necessary personal data required for the insurance agreement. This practice reduces the amount of data vulnerable to compromise and improves compliance with data privacy regulations.

- Data Retention Policy: Develop a clear data retention policy to specify how long personal data will be stored. This policy should align with legal and regulatory requirements and ensure data is deleted or anonymized when no longer needed.

Example Security Protocols Table

| Security Protocol | Description |

|---|---|

| Encryption (TLS/SSL) | Data transmission is secured using encryption protocols to prevent unauthorized access during transmission. |

| Access Control (RBAC) | Role-Based Access Control (RBAC) limits access to data based on predefined roles, preventing unauthorized access. |

| Regular Security Audits | Periodic evaluations of security measures and identification of vulnerabilities are crucial. |

| Data Minimization | Collect only the necessary data for the agreement, minimizing the risk of data breaches. |

| Data Retention Policy | Establish a policy defining how long personal data is stored, aligning with legal and regulatory requirements. |

Practical Applications and Examples

This section provides practical examples of an agreement to provide insurance, specifically focusing on health insurance, along with revised versions emphasizing clarity and security. It demonstrates how such a form functions in real-world scenarios and illustrates a data privacy statement tailored to this specific form.

Health Insurance Agreement Form Example

This example Artikels a simplified agreement for health insurance coverage. The form’s purpose is to establish the terms and conditions of the agreement between the insurance provider and the insured individual.

Agreement to Provide Health Insurance Policyholder Name: _________________________ Policyholder Address: _________________________ Policyholder Phone Number: _________________________ Policyholder Email Address: _________________________ Effective Date: _________________________ Insured Person Name: _________________________ Relationship to Policyholder (if applicable): _________________________ Date of Birth: _________________________ Social Security Number (Optional): _________________________ Coverage Details: [List of covered services, benefits, and exclusions in detail] Premium Information: [Details of premium amount, payment schedule, and late payment policies] Claims Process: [Step-by-step process for filing claims] Policy Cancellation Policy: [Conditions under which the policy may be cancelled by either party] Governing Law: [State or jurisdiction] Signature of Policyholder: _________________________ Date: _________________________ Signature of Insurance Provider Representative: _________________________ Date: _________________________

Revised Form with Enhanced Clarity and Security

This revised form incorporates improvements to enhance clarity and security, reflecting best practices.

The key changes focus on precise language, explicit data handling policies, and enhanced security measures.

Agreement to Provide Health Insurance - Revised [... (All fields from the previous example, with the addition of the following)] Data Privacy Statement: [Insert a concise data privacy statement, highlighting how personal information will be handled and used, including details about data retention, security measures, and data subject rights. This section should clearly comply with relevant data privacy regulations.] Acknowledgement of Data Privacy Policy: By signing this agreement, the policyholder acknowledges and agrees to the terms of the attached data privacy policy. [...(Rest of the form fields)]

Real-World Scenario

An individual, John Smith, wishes to enroll in a health insurance plan. He completes the agreement form, providing all necessary details. The insurance provider processes his application, verifies his information, and confirms the policy terms. Upon successful completion, John receives a confirmation letter outlining the specific coverage, premium details, and claims procedures.

This form ensures a clear understanding of the agreement between the parties.

Data Privacy Statement Example

This statement Artikels how the insurance provider will handle personal information collected from the agreement form.

As you contemplate the agreement to provide insurance form pdf, remember that each commitment is a step towards alignment with your highest potential. This form, a testament to your willingness to protect, mirrors the profound commitment we all have to safeguard our well-being. Consider the delicious options on Michael’s Pizza & More menu michael’s pizza & more menu – each choice, like this insurance agreement, represents a conscious agreement with yourself.

This commitment, like the form, holds the potential for abundance and fulfillment.

“This company is committed to protecting the privacy of your personal information. All data collected will be used solely for the purpose of administering your health insurance policy. Your data will be stored securely and will be accessed only by authorized personnel. We comply with all applicable data privacy laws, including [mention specific laws]. You have the right to access, correct, or delete your personal information. Please contact us at [contact information] with any questions or concerns regarding your data privacy.”

Document Formatting and Accessibility

Proper formatting and accessibility are crucial for ensuring that the insurance agreement form is usable by all intended recipients. A well-structured and accessible PDF streamlines the completion process and promotes inclusivity. This section Artikels best practices for creating a user-friendly and accessible document.

Optimal Readability and Usability

The formatting of the PDF significantly impacts the user experience. Clear and consistent fonts, appropriate font sizes, and sufficient line spacing contribute to readability. Use a sans-serif font like Arial or Calibri for better readability, especially for long documents. Font sizes should be large enough to be easily read by people with visual impairments or those using smaller screens.

Adequate line spacing prevents visual fatigue. Avoid using overly decorative fonts that may be difficult to read. Consistent formatting throughout the document enhances readability. Employ logical headings and subheadings to break down the content and make navigation easier. Use visual aids like tables and charts where appropriate, but ensure they are clear and concise, accompanied by appropriate captions.

Employ white space strategically to improve the visual appeal and readability.

Accessibility Considerations

Creating an accessible PDF is essential for compliance and user inclusivity. Accessibility considerations ensure that the document is usable by individuals with disabilities, including those with visual, auditory, cognitive, or motor impairments. This involves using appropriate color contrasts to ensure readability for individuals with visual impairments, providing alternative text for images, and using clear and concise language. Ensure the document is compatible with assistive technologies like screen readers.

Providing alternative text for images enables screen readers to describe the content to visually impaired users. The use of semantic HTML tags within the PDF document, if applicable, further enhances accessibility.

Formatting Options and Accessibility Standards

Implementing best practices in formatting will enhance accessibility. The following table provides examples of formatting options, their impact on accessibility, and relevant standards.

Embarking on a journey, like securing an agreement to provide insurance form pdf, requires careful consideration. This vital step, akin to meticulously planning a trip from Las Vegas to the awe-inspiring Grand Canyon, train from vegas to grand canyon , ensures a smooth and protected passage. Understanding the agreement, like the landscape you traverse, fosters peace of mind, allowing your journey to unfold harmoniously.

Ultimately, a completed agreement to provide insurance form pdf ensures protection and facilitates the path ahead.

| Formatting Option | Impact on Accessibility | Relevant Standards |

|---|---|---|

| Clear and consistent font choices (e.g., Arial, Calibri) | Improved readability for a wider audience, including those with visual impairments. | WCAG (Web Content Accessibility Guidelines) |

| Appropriate font sizes (e.g., 12pt minimum) | Enhanced readability for individuals with visual impairments or those using smaller screens. | WCAG |

| Sufficient line spacing (e.g., 1.5 lines) | Reduces visual fatigue and improves readability. | WCAG |

| Logical headings and subheadings | Improved document structure and navigation, allowing assistive technologies to better understand the content hierarchy. | WCAG |

| Alternative text for images | Provides descriptions for images, enabling screen readers to convey the information to visually impaired users. | WCAG |

| Color contrast ratios (e.g., 4.5:1 for text) | Ensures sufficient contrast between text and background colors for individuals with visual impairments. | WCAG |

Creating a User-Friendly Online Form

To ensure a user-friendly online experience, consider these points. Employ a clear and intuitive layout, with appropriate spacing between form fields. Use labels that clearly indicate the type of information required. Provide concise instructions and guidance on completing each field. Implement form validation to prevent common errors and provide feedback to the user.

Ensure the PDF form is compatible with various browsers and devices. Consider using a digital signature feature for added security and legal verification. This approach facilitates seamless completion and submission of the form online.

Comparison with Alternative Forms

Different jurisdictions employ various approaches to managing insurance agreements. Understanding these alternatives is crucial for selecting the most suitable method for a specific context. This comparison considers the strengths and weaknesses of different approaches, including traditional paper forms, online portals, and electronic signatures, to provide a comprehensive overview.

Traditional paper-based forms, while familiar, often present challenges in terms of security and accessibility. Modern alternatives offer improvements in efficiency, security, and user experience.

Traditional Paper Forms

Paper-based agreements, while readily accessible in some contexts, have inherent limitations. Their security can be compromised through unauthorized access or loss. Updating or amending the agreement is a lengthy process, and tracking changes is often difficult. Storage and retrieval are also significant considerations.

Online Portals

Online portals facilitate streamlined agreement processes. They allow for secure storage and retrieval of documents, enabling quick access and revision. This approach often reduces administrative burdens and improves efficiency. However, implementing and maintaining such a portal requires significant investment.

Electronic Signatures

Electronic signatures provide a secure and legally sound alternative to traditional signatures. They offer greater efficiency and speed, allowing for immediate agreement processing. Integrating electronic signatures into online portals or other systems enhances the overall process. However, legal frameworks governing electronic signatures vary by jurisdiction.

Comparison Table

| Approach | Costs | Security | Accessibility | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Traditional Paper Forms | Relatively low initial cost | Vulnerable to loss, theft, and unauthorized access | Accessible in most areas, but limited to physical location | Familiar and readily available | Slow process, poor tracking, high potential for errors |

| Online Portals | Higher initial cost for development and maintenance | Potentially higher security through encryption and access controls | Accessible through internet connection | Efficient, streamlined process, easy updates | Requires technical expertise, potential for system failures |

| Electronic Signatures | Cost varies based on the platform used | High security through encryption and digital authentication | Accessible to users with internet connection | Secure, legally sound, faster processing | Legal acceptance varies by jurisdiction, technical issues can arise |

Examples of Alternative Approaches

In some jurisdictions, insurance companies utilize online portals for policy applications and renewals. This approach streamlines the process, enabling faster turnaround times and improved customer satisfaction. Furthermore, many countries have established legal frameworks for electronic signatures, making them a viable option for insurance agreements.

Technical Considerations

Creating a robust and user-friendly PDF form for electronic submission requires careful consideration of various technical aspects. These considerations ensure the form functions seamlessly across different devices and software platforms, and integrates smoothly with existing insurance systems and electronic signature solutions. This section details the key technical aspects for successful electronic form implementation.

PDF Form Creation and Functionality

PDF forms, while widely used, demand specific technical knowledge for effective electronic filling and submission. The form’s design should prioritize ease of use and accuracy, preventing errors and ensuring data integrity. Key considerations include using standardized fields for data entry, employing validation rules to prevent incorrect input, and incorporating interactive elements like drop-down menus and radio buttons to enhance user experience.

Robust error handling and feedback mechanisms should be built into the form to guide users through the process.

Device and Software Compatibility

To ensure broad accessibility, the PDF form should be designed with compatibility across various devices and software platforms in mind. Different browsers, operating systems, and mobile devices may render the form differently. Testing the form across a range of devices and browsers is crucial to identify potential display issues or usability problems. Accessibility features should be integrated, such as alternative text for images and keyboard navigation.

Using a standard PDF format and avoiding complex layouts will enhance compatibility.

Integration with Existing Insurance Systems

Integrating the form with existing insurance systems is crucial for efficient data flow. This often involves connecting the form’s data fields to corresponding data fields within the insurance database. API integration is a common approach for this. Careful mapping of data fields is necessary to ensure accurate and consistent data transfer. The integration should also accommodate data validation rules and error handling to maintain data integrity.

The process should be designed to minimize disruptions to existing workflows.

Electronic Signature Integration

Implementing electronic signature solutions within the PDF form enhances security and efficiency. The form should support various electronic signature standards and methods. This integration should ensure that the signatures are legally valid and compliant with relevant regulations. It is essential to choose an e-signature provider with robust security features to protect sensitive information. The form should clearly guide users through the e-signature process.

Wrap-Up

In conclusion, creating and utilizing an agreement to provide insurance form PDF requires careful consideration of legal, security, and user experience aspects. This guide provides a comprehensive overview, equipping you with the knowledge to navigate these forms effectively. Remember to prioritize clarity, security, and accessibility to ensure a smooth process for all parties involved.

FAQs

What are the common sections found in an agreement to provide insurance form?

Typical sections include personal information, insurance details, and the agreement terms themselves. A well-structured form clearly Artikels these sections.

How do I ensure the form is compliant with data privacy regulations?

Adhere to regulations like GDPR when collecting and handling personal information. Implement robust security measures to protect sensitive data.

What are some common legal pitfalls to avoid in drafting the agreement?

Ambiguous or incomplete clauses can lead to legal issues. Clarity and precision are paramount. Consult with legal professionals if needed.

How can I make the PDF form user-friendly for online submission?

Optimize the PDF’s format for readability and accessibility. Provide clear instructions and guidance for users.