Do I need PIP insurance if I have Medicare? This crucial question arises when navigating the complexities of healthcare coverage. Medicare provides extensive medical benefits, but understanding its limitations and the role of Personal Injury Protection (PIP) insurance is essential for making informed decisions.

Medicare’s comprehensive coverage typically includes doctor visits, hospital stays, and prescription drugs. However, it may not fully cover all medical expenses, leaving gaps in coverage that supplemental insurance like PIP can address. Understanding these gaps is key to determining if you need additional protection beyond Medicare.

Understanding Medicare Coverage

Medicare, the venerable government health insurance program, offers a complex, yet crucial safety net for millions of Americans. Navigating its intricacies can feel like deciphering a cryptic medical text, but with a bit of patience and the right perspective, its benefits become quite clear. Understanding Medicare’s coverage is essential for making informed decisions about your healthcare needs and financial planning.Medicare is a multifaceted program, offering various components to address diverse healthcare requirements.

Its design is a fascinating blend of public and private elements, aiming to balance the needs of the insured with the practicality of a national healthcare system.

Medicare Parts: A Comprehensive Overview

Medicare is divided into four parts, each tackling different aspects of medical expenses. This segmentation allows for a more targeted and tailored approach to healthcare coverage.

- Part A (Hospital Insurance): This part primarily covers inpatient care, such as stays in hospitals, skilled nursing facilities, and hospice care. Medicare Part A often covers a significant portion of these costs, making it a cornerstone of the program. Importantly, eligibility for Part A frequently hinges on prior employment and social security contributions. This ensures a more equitable distribution of the costs associated with these vital services.

- Part B (Medical Insurance): Part B covers a wide array of outpatient services, including doctor’s visits, preventive services, and medical equipment. This part acts as a supplementary layer of protection, filling in gaps left by Part A. It’s a critical component for managing routine and non-emergency medical needs. This part is an essential part of maintaining overall health and well-being.

- Part C (Medicare Advantage): Part C, also known as Medicare Advantage, is a private insurance option that combines benefits from Parts A, B, and often Part D. These plans are run by private insurance companies, and offer additional benefits beyond the basic Medicare coverage. They provide an alternative for those seeking a broader array of services or more comprehensive coverage options.

Choosing a Medicare Advantage plan involves a significant consideration of the specific benefits offered and the network of providers.

- Part D (Prescription Drug Insurance): Part D focuses on prescription drug coverage, a critical aspect of healthcare management. It provides financial assistance for medications, thereby lessening the financial burden associated with prescription costs. This part of the program is crucial for managing chronic conditions and maintaining overall health. It plays a significant role in preventing costly medical complications related to untreated conditions.

Covered and Non-Covered Services

Medicare, while extensive, has limitations in its coverage. Understanding the scope of covered services is essential for informed healthcare decision-making.

- Covered Services: Medicare typically covers a wide range of services, including physician visits, preventive care, hospital stays, and some types of mental health services. It is important to note that specific benefits vary between plans and may be subject to cost-sharing requirements.

- Non-Covered Services: Medicare does not cover certain services, such as cosmetic procedures, dental care (except in certain situations), and eyeglasses. It’s crucial to recognize the boundaries of Medicare coverage to avoid unexpected financial burdens.

Medicare vs. Private Insurance: A Comparative Analysis

This table highlights key differences between Medicare and typical private health insurance plans.

| Feature | Medicare | Typical Private Health Insurance |

|---|---|---|

| Premiums | Generally lower, though can vary by plan and individual circumstances. | Premiums often higher, depending on the plan and coverage. |

| Coverage Scope | Comprehensive but with limitations. | Typically broader coverage, with greater flexibility in plan options. |

| Cost-Sharing | Co-pays, deductibles, and co-insurance are common. | Co-pays, deductibles, and co-insurance are common but vary widely by plan. |

| Network Access | Typically includes a network of providers. | Network of providers can be broader and more diverse. |

Identifying Gaps in Medicare Coverage: Do I Need Pip Insurance If I Have Medicare

Medicare, while a remarkable program, does have its limitations. Imagine a well-stocked pantry – it’s great, but you might still need to supplement it with items not included. Similarly, Medicare provides comprehensive coverage, but there are areas where its benefits may not be sufficient, necessitating supplemental insurance to fill the gaps.Navigating these gaps requires a keen understanding of what Medicaredoesn’t* cover, and how those gaps might impact your financial well-being.

It’s a bit like playing a game of “find the missing pieces” with your healthcare needs. Understanding these areas can help you make informed decisions about your supplemental insurance.

Common Situations Where Medicare Benefits May Not Be Sufficient

Medicare, while a cornerstone of healthcare in the United States, has limitations. Understanding these limitations is crucial to ensuring comprehensive healthcare coverage. These limitations include a variety of scenarios where supplemental insurance may be necessary to bridge the gap.

- Long-Term Care: Medicare primarily focuses on short-term, acute care. Long-term care facilities, such as nursing homes, often require significant, ongoing funding, which Medicare does not typically cover. This can be a considerable financial burden, making long-term care insurance a vital consideration for many individuals.

- Dental and Vision Care: Medicare does not cover routine dental care or vision care. These essential services, such as checkups, cleanings, and eye exams, can be costly and should be addressed through supplemental insurance or out-of-pocket payments.

- Prescription Drug Costs: While Medicare Part D covers prescription drugs, the costs can still be substantial. A significant portion of the costs may need to be covered by the beneficiary, leading to the need for supplemental plans or managing expenses meticulously.

- Hearing Aids: Medicare does not cover the cost of hearing aids. The cost of hearing aids and related services can be substantial, making supplemental insurance a crucial factor for many.

Potential Scenarios Where Supplemental Insurance Might Be Necessary

Considering the limitations of Medicare, many situations necessitate supplemental insurance to address potential financial vulnerabilities. One such example is a scenario where Medicare might not fully cover the expenses of an illness.

- Extensive Hospital Stays: While Medicare covers hospital stays, there might be circumstances where the cost of extended stays or specific treatments might exceed Medicare’s coverage, and supplemental insurance can be a critical financial buffer.

- Chronic Conditions: Individuals with chronic conditions, such as diabetes or heart disease, might require ongoing medical care beyond what Medicare covers, necessitating supplemental insurance for ongoing expenses.

- Specialized Treatments: Certain specialized treatments, like rehabilitation or therapies, might not be fully covered by Medicare, requiring supplemental insurance to bridge the gap.

Examples of Medical Expenses Not Fully Covered by Medicare

Medicare’s coverage is extensive, but it has inherent limitations. Certain medical expenses fall outside its purview, necessitating supplemental insurance or personal financial resources.

| Type of Expense | Medicare Coverage | Potential Need for Supplemental Insurance |

|---|---|---|

| Long-term care facility costs | Limited or no coverage | Essential for most situations |

| Dental care (checkups, cleanings, etc.) | No coverage | Absolutely necessary |

| Vision care (exams, glasses, etc.) | No coverage | Crucial for maintaining vision health |

| Hearing aids | No coverage | Often a significant expense |

| Prescription drug costs (beyond the Part D deductible) | Covers a portion | Often requires supplemental plans or careful budgeting |

Exploring PIP Insurance

A crucial component of personal financial planning, particularly when navigating healthcare costs, is understanding supplemental insurance options. While Medicare provides a robust foundation, certain gaps may exist, leaving you needing a safety net. Personal Injury Protection (PIP) insurance is one such net. Let’s delve into its specifics and how it interacts with Medicare.PIP insurance, a type of auto insurance coverage, acts as a safeguard against medical expenses arising from an accident, regardless of fault.

Think of it as a financial cushion, readily available to cover your medical bills, lost wages, and other expenses, should the unfortunate happen.

Defining Personal Injury Protection (PIP) Insurance

PIP insurance is designed to cover medical expenses and lost wages resulting from a car accident, irrespective of who was at fault. It’s a vital safety net, especially in cases of significant injuries or extended recovery periods. A key feature is its ability to provide financial relief without the complexities of proving fault or dealing with the legal ramifications of an accident.

This is in stark contrast to traditional medical insurance which often requires proof of negligence before payouts.

How PIP Insurance Works with Medical Expenses

PIP insurance directly covers medical expenses incurred as a result of an accident. This includes doctor visits, hospital stays, physical therapy, and prescription medications. Importantly, it often provides coverage even if you are at fault for the accident. This stands in contrast to some other forms of insurance, where fault plays a significant role in determining coverage.

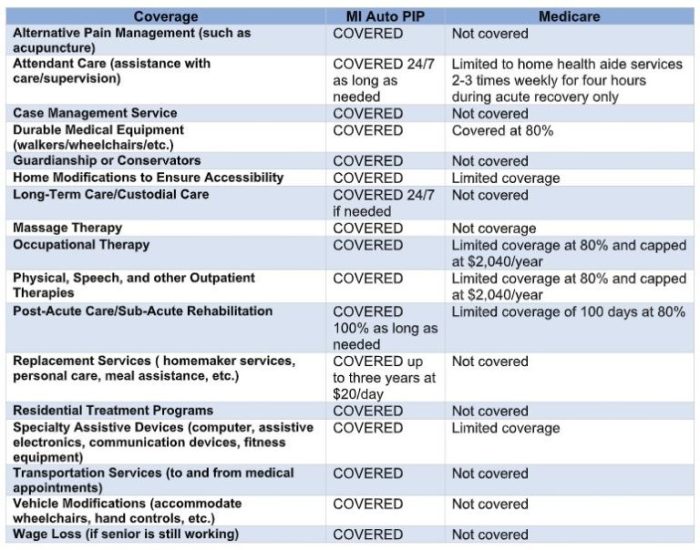

Comparing PIP Coverage with Medicare

While Medicare provides comprehensive healthcare coverage for eligible individuals, PIP insurance offers a distinct advantage in certain situations. Medicare, for example, typically doesn’t cover expenses directly related to an accident, such as lost wages or car repair costs. PIP insurance can often provide these vital supplements, especially if the accident results in a significant financial burden. Essentially, PIP acts as a safety net for accident-related expenses that Medicare may not cover fully.

Situations Where PIP Might Be Relevant Even with Medicare

Even with Medicare, situations arise where PIP insurance can provide substantial support. Consider a scenario where a car accident leads to extensive medical treatment exceeding the limits of Medicare coverage. In such cases, PIP insurance acts as a crucial supplemental coverage. Furthermore, if the accident results in significant lost wages, PIP can provide a crucial safety net.

For example, a period of prolonged recovery could significantly impact an individual’s ability to work, and PIP could help mitigate this financial strain.

Assessing the Need for PIP Insurance with Medicare

Navigating the labyrinthine world of healthcare insurance can feel like trying to assemble IKEA furniture blindfolded. Medicare, while a fantastic safety net, doesn’t always cover every bump in the road. Enter PIP insurance, a potentially helpful extra layer of protection, especially in the unfortunate event of an accident. Let’s delve into when this extra coverage might be a wise addition to your Medicare plan.Understanding the specific limitations of Medicare coverage is crucial in determining the necessity of supplementary insurance like PIP.

While Medicare excels in handling hospital stays and physician visits, there are often gaps in coverage for other crucial aspects of accident recovery. PIP insurance, in contrast, frequently steps in to fill these gaps.

Scenarios Requiring Additional PIP Coverage

PIP insurance often comes into play when accidents and injuries result in expenses not fully covered by Medicare. For example, if a covered Medicare patient suffers a car accident resulting in significant pain and physical therapy, Medicare might not fully cover the costs of these treatments. PIP insurance can step in to cover the gap, providing crucial support during the recovery process.

Potential Benefits of Dual Coverage

The combination of Medicare and PIP insurance creates a powerful shield against unforeseen medical expenses. Medicare handles the core medical needs, while PIP takes care of additional costs associated with accidents, such as pain management, lost wages, and even vehicle repairs. This dual approach provides a comprehensive safety net, reducing financial stress in the event of an accident.

Redundancy with Medicare Coverage

In certain circumstances, PIP insurance might prove redundant with Medicare coverage. For instance, if an individual’s accident results solely in injuries covered under Medicare’s extensive benefits, PIP coverage might not add significant value. Careful consideration of individual circumstances and the specific details of each insurance plan is essential to make an informed decision.

Circumstances Where PIP is Beneficial (Even with Medicare)

| Situation | PIP Benefit Explanation |

|---|---|

| Car Accidents (with injuries beyond Medicare coverage) | PIP insurance often covers expenses related to pain management, physical therapy, and lost wages that might not be fully covered by Medicare. |

| Injuries from other accidents (e.g., slips and falls) | Similar to car accidents, PIP can cover non-Medicare-covered expenses for injuries sustained from other accidents. |

| Property Damage (in certain cases) | Some PIP plans may also provide coverage for property damage related to the accident. |

| Temporary Disability or Lost Wages | PIP can provide financial assistance for lost income due to injuries sustained in an accident, a benefit often not fully covered by Medicare. |

Practical Considerations and Recommendations

Navigating the labyrinthine world of healthcare insurance can feel like deciphering ancient hieroglyphics. Thankfully, we’re here to demystify the question of whether you need PIP insuranceon top of* your Medicare coverage. Understanding the nuances of each plan is key to making an informed decision. It’s not about being overwhelmed; it’s about being empowered.Medicare, while a remarkable safety net, may have some gaps.

So, you’re wondering if you need PIP insurance if you have Medicare, right? Well, checking out a new nail salon at the mall, nail salon at the mall , might not be the best way to find out. The short answer is probably not, but you should still double-check with your insurance provider to be sure.

Medicare often covers a lot, but there are always specifics you need to know.

Adding PIP insurance can be a smart strategy to protect yourself financially in certain situations. A thorough assessment of your individual needs and the specific terms of your coverage is crucial to avoiding unnecessary expenses.

Factors Influencing PIP Insurance Need with Medicare

Understanding the specifics of your situation is paramount when deciding if PIP insurance is necessary alongside your Medicare benefits. Consider the following key factors:

- Your Lifestyle and Activities:

- Are you a frequent driver? Do you engage in high-risk activities that might increase your chances of a car accident? If so, PIP insurance might provide an extra layer of financial protection beyond what Medicare covers.

- A stay-at-home parent or someone who primarily relies on public transportation may require less coverage compared to someone frequently driving.

- Your Financial Situation:

- How significant are your out-of-pocket medical expenses? If you have limited savings or anticipate substantial medical bills, PIP insurance might help manage the financial strain of an accident, irrespective of Medicare coverage.

- Compare the premiums of PIP insurance to the possible costs of an accident and your Medicare’s out-of-pocket maximum. A thorough financial assessment can help determine if the additional coverage is worthwhile.

- Medicare’s Coverage Gaps:

- Medicare does not typically cover expenses related to car accidents, like repairs or lost wages, although it may cover medical expenses. PIP insurance often steps in to fill those gaps.

- Comprehending the limits of Medicare’s coverage for medical expenses after an accident is crucial in assessing your need for supplemental insurance.

Costs of PIP Insurance and Medicare Premiums, Do i need pip insurance if i have medicare

A critical consideration is the relationship between PIP insurance premiums and your Medicare premiums. The costs of PIP insurance are usually dependent on several factors.

- Factors Influencing PIP Insurance Premiums:

- Your driving history, the coverage limits you select, and the specific terms of your policy all contribute to the premium amount.

- The deductible and the co-pay amounts can also impact the overall cost.

- Compare PIP insurance premiums to the potential financial burden of an accident without it. This comparison can help you determine if the added cost is justified by the potential benefits.

Questions to Ask When Evaluating PIP Insurance Options

Evaluating PIP insurance options requires a methodical approach. Ask yourself the following questions:

- What are the specific coverage limits provided by the PIP insurance?

- What are the deductibles and co-pay amounts associated with the policy? How do they compare to potential out-of-pocket expenses for medical care in the event of an accident?

- How does the PIP policy interact with Medicare’s coverage for medical expenses? Does it complement or overlap? How are the coverage limits calculated?

- Is there a waiting period or exclusion clause in the PIP policy that might affect your coverage?

Factors Influencing Need for PIP Insurance with Medicare

Identifying situations where additional PIP insurance is beneficial is essential.

- High-risk driving situations: Frequent highway driving or commuting in densely populated areas might necessitate additional coverage. This is particularly true if you have a history of accidents.

- Limited personal financial resources: If you have limited savings or anticipate substantial medical bills, PIP insurance can provide crucial financial protection in the event of an accident.

- Specific coverage gaps: Medicare may not cover all accident-related expenses, such as vehicle repairs or lost wages. PIP insurance can fill these gaps and provide a safety net.

- Extensive medical needs: If you have a pre-existing condition or anticipate needing extensive medical treatment, additional protection may be prudent.

Illustrative Examples

Navigating the complex world of Medicare and PIP insurance can feel like deciphering a cryptic medical chart. Fear not, intrepid reader! Let’s illuminate some real-world scenarios to demystify the necessity – or lack thereof – of PIP alongside Medicare coverage.Understanding the interplay between these two crucial forms of insurance is key to avoiding costly medical surprises. We’ll explore instances where Medicare alone falls short, where it shines, and where PIP adds unnecessary layers of expense.

So, you’re looking at buying a sweet new place like the home for sale wickenburg az lazy fox ? Figuring out if you need PIP insurance if you have Medicare is a good question, though. Medicare usually doesn’t cover things like PIP, so you’ll probably want to check with your insurance agent to be sure. Just make sure you’re covered if you’re planning on driving around town.

Medicare Alone Insufficient

Medicare, while a remarkable safety net, has its limitations. A catastrophic accident, requiring extensive rehabilitation or long-term care, might easily exceed Medicare’s coverage. Imagine a scenario where a senior citizen sustains a debilitating hip fracture during a fall. Medicare might cover the initial hospital stay and surgery, but ongoing physical therapy, assistive devices, and potentially long-term care facility costs might far surpass Medicare’s reimbursements.

In this instance, PIP insurance could be the critical missing piece, covering the gaps in Medicare’s coverage.

Medicare and PIP Adequate

A different scenario: A person slips and falls on an icy sidewalk, sustaining minor cuts and bruises. Medicare, in this case, doesn’t directly cover the incident. However, the PIP coverage would likely cover the medical expenses related to the incident, including doctor visits, stitches, and prescribed medications. Since the injuries are relatively minor, Medicare wouldn’t have a role.

This demonstrates how PIP insurance can be crucial for less severe injuries, while Medicare covers the broader spectrum of healthcare.

PIP Unnecessary with Medicare Coverage

A person experiences a common cold, requiring a doctor’s visit. This situation typically falls squarely within Medicare’s purview, with coverage for the doctor’s consultation and any prescribed medication. PIP insurance, in this case, is superfluous. Medicare’s coverage adequately addresses the medical costs. This simple example illustrates where PIP’s role is limited to injuries arising from accidents.

PIP Costs Outweigh Benefits

While PIP can be invaluable, sometimes the premium cost outweighs the potential benefits, even with Medicare. Consider a person with a pre-existing medical condition, such as arthritis, and who experiences a relatively minor injury from a fender bender. While PIP might cover the initial medical expenses, the premiums for such coverage could prove to be a significant burden, especially when Medicare’s benefits already address the individual’s pre-existing condition and the minor injury.

In this case, the financial burden of the PIP insurance may be more substantial than the benefits it provides.

Final Wrap-Up

In conclusion, determining if PIP insurance is necessary alongside Medicare depends on individual circumstances and potential medical needs. Factors like accident risks, pre-existing conditions, and desired level of financial protection all play a role. By carefully considering the specifics of your situation, you can make an informed choice that best aligns with your healthcare needs and budget.

FAQ Overview

Does Medicare cover all medical expenses?

No, Medicare does not cover all medical expenses. There are specific services and conditions that fall outside of its coverage, such as long-term care, dental care, and vision care.

What is PIP insurance?

Personal Injury Protection (PIP) insurance is a type of car insurance that covers medical expenses related to injuries sustained in a car accident, regardless of who is at fault. It often covers expenses not fully covered by Medicare.

Can I have both Medicare and PIP insurance?

Yes, you can have both Medicare and PIP insurance. In fact, having both may provide more comprehensive coverage for medical expenses, especially in accident-related situations.

What are some factors to consider when deciding if I need PIP insurance with Medicare?

Factors to consider include your driving habits, risk tolerance, pre-existing conditions, and the potential costs of PIP insurance relative to Medicare premiums. A consultation with a financial advisor or insurance agent can provide personalized guidance.