Will insurance cover CGM for PCOS? This perplexing question often leaves individuals grappling with the intricacies of healthcare coverage. Navigating the labyrinthine world of insurance policies, pre-existing conditions, and specific treatments for PCOS can be daunting. Understanding the potential coverage for continuous glucose monitors (CGMs) in the context of Polycystic Ovary Syndrome (PCOS) requires careful examination of individual policies and the nuances of medical necessity.

This comprehensive exploration delves into the complexities of insurance coverage for PCOS-related conditions, including the specific considerations surrounding CGM use. We will unravel the intricacies of coverage, examining the different types of insurance, common exclusions, and the claim process. By understanding the interplay between insurance policies and PCOS-related medical needs, you’ll gain the knowledge to navigate the complexities and potentially secure the necessary support.

Defining Coverage for PCOS-related Conditions

Salam sejahtera, dear readers! Understanding your insurance coverage for Polycystic Ovary Syndrome (PCOS) related conditions is crucial for managing your health effectively. This section delves into the specifics of how various insurance policies handle PCOS, from diagnostic testing to treatments and medications.Insurance policies, while designed to provide financial support during challenging times, often have specific stipulations and limitations.

It’s important to review your policy documents carefully and consult with your insurance provider or a qualified advisor to ensure you are fully aware of your coverage options.

Types of Insurance Coverage

Insurance coverage for PCOS-related conditions can vary significantly. Some policies offer comprehensive coverage for diagnostic testing, treatments, and medications, while others may have limitations or exclusions. This can include things like fertility treatments, hormone therapies, and surgical interventions. It’s essential to be clear about the extent of your policy’s benefits.

Handling Pre-existing Conditions

Many insurance policies have provisions for pre-existing conditions. PCOS, like other chronic conditions, may be categorized as a pre-existing condition. How insurance companies address this varies widely. Some policies may exclude coverage for pre-existing conditions entirely, or they may have waiting periods before coverage begins. Others may offer coverage but with limitations, such as higher deductibles or co-pays.

It’s vital to understand how your policy handles pre-existing conditions related to PCOS.

Exclusions and Limitations

Insurance policies often contain exclusions and limitations concerning coverage for PCOS-related care. These exclusions can pertain to diagnostic tests (such as blood tests or ultrasounds), treatments (like medication or surgery), and medications (prescription drugs). It is crucial to review your policy’s specific wording regarding these exclusions. Some policies might not cover experimental or investigational treatments, while others may have limits on the amount they will pay for specific procedures.

Specific Situations with No Coverage, Will insurance cover cgm for pcos

Insurance policies may not cover certain PCOS-related procedures. This could include treatments or surgeries deemed experimental, procedures that are considered cosmetic, or care deemed unnecessary by the insurance company. It is wise to confirm the specific criteria for coverage with your insurance provider before pursuing any PCOS-related procedures.

Comparison of Coverage by Insurance Providers

Understanding how different insurance providers handle PCOS coverage is beneficial. The table below provides a basic comparison, but it is critical to consult your specific policy for accurate information.

| Insurance Provider | Coverage for Diagnostic Tests | Coverage for Medications | Coverage for Treatments |

|---|---|---|---|

| Example Provider 1 | Full Coverage | Partial Coverage (with limitations on specific drugs) | Limited Coverage (certain procedures excluded) |

| Example Provider 2 | Partial Coverage (may have co-pays or deductibles) | Full Coverage (for FDA-approved drugs) | Partial Coverage (dependent on the complexity of the treatment) |

Remember, this is a simplified comparison. Actual coverage can vary significantly based on individual policy details. Always consult your policy documents and insurance provider for precise information. Your health and well-being are paramount; seeking clarity on insurance coverage is a proactive step toward managing your PCOS effectively.

Understanding PCOS and its Related Medical Needs: Will Insurance Cover Cgm For Pcos

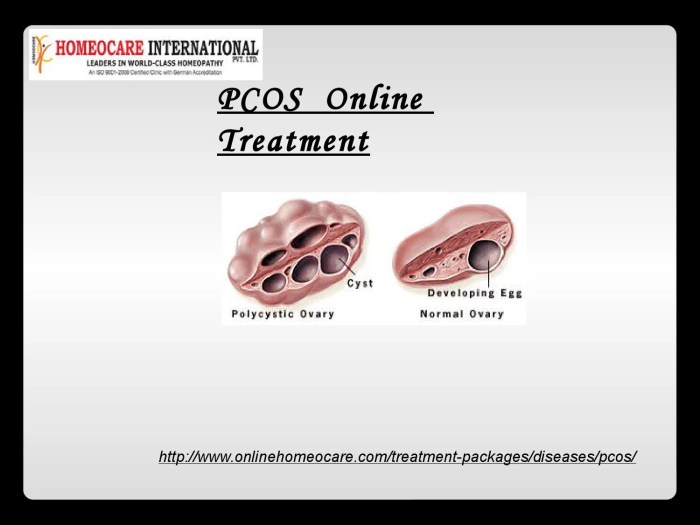

Salam sejahtera! Polycystic ovary syndrome (PCOS) is a common hormonal disorder affecting women of reproductive age. It’s important to understand the various medical conditions associated with PCOS, the diagnostic process, treatment options, and the healthcare professionals involved in managing this condition. This will help women make informed decisions about their health.PCOS is a complex condition, and its symptoms can vary greatly from woman to woman.

This multifaceted nature of PCOS often leads to a range of associated medical issues, which is why comprehensive understanding and appropriate management are crucial. Recognizing the interconnectedness of these conditions allows for more targeted and effective treatment plans.

Common Medical Conditions Associated with PCOS

The hormonal imbalances inherent in PCOS can contribute to a variety of medical conditions. These include irregular menstrual cycles, difficulty conceiving, acne, excess hair growth (hirsutism), and even an increased risk of developing type 2 diabetes, high blood pressure, and heart disease. It is important to note that not all women with PCOS will experience all of these conditions, and the severity can vary significantly.

PCOS Diagnostic Process

Diagnosing PCOS typically involves a combination of medical history, physical examination, and laboratory tests. A thorough discussion of menstrual cycles, symptoms, and family history is essential. A physical examination, including evaluation of body composition and signs of hirsutism, is performed. Furthermore, blood tests to measure hormone levels, including androgens, follicle-stimulating hormone (FSH), luteinizing hormone (LH), and insulin levels, are commonly used.

Ultrasound imaging of the ovaries may also be employed to evaluate the ovarian morphology and rule out other conditions.

Common Treatment Options for PCOS and Associated Conditions

Effective management of PCOS often involves a multi-pronged approach, tailoring treatment to the individual needs and symptoms. Lifestyle modifications, such as regular exercise and a balanced diet, play a crucial role in managing weight, improving insulin sensitivity, and regulating hormone levels. Medications, including oral contraceptives, anti-androgens, and metformin, may be prescribed to regulate menstrual cycles, reduce androgen levels, and improve insulin resistance.

For fertility concerns, specific fertility treatments might be necessary.

Types of Medical Professionals Involved in PCOS Care

Several medical professionals are often involved in managing PCOS and its associated conditions. These include gynecologists, endocrinologists, family doctors, and registered dietitians. Each specialist brings unique expertise to the table, working collaboratively to create a comprehensive care plan.

Treatments and Associated Costs

| Treatment Type | Description | Approximate Cost (Estimated) |

|---|---|---|

| Lifestyle Modifications (Diet & Exercise) | Dietary changes to improve insulin sensitivity, regular exercise, stress management. | Low to moderate, depending on the specific programs or consultations |

| Oral Contraceptives | Regulate menstrual cycles and reduce androgen levels. | Variable, depending on the type of pill. A few hundred Rupiah to a few thousand Rupiah per month, based on the cost of prescription in local pharmacies. |

| Metformin | Improve insulin sensitivity, reducing blood sugar levels. | Typically a few hundred Rupiah per month. |

Note: The estimated costs are approximate and can vary significantly based on individual circumstances, location, and specific treatments. It’s essential to consult with a healthcare professional for personalized cost estimations.

Exploring Insurance Claim Processes and Documentation

Filing an insurance claim for PCOS-related care can feel like navigating a complex maze. Understanding the steps involved and the necessary documentation is crucial for a smooth and successful claim process. Knowing what to expect can ease your worries and increase your chances of receiving the coverage you need. Let’s delve into the details of this process, ensuring you’re well-prepared.Navigating the insurance claim process for PCOS-related care requires a clear understanding of the steps involved and the documentation needed.

This section Artikels the typical procedures, from pre-authorization to follow-up, and details the importance of comprehensive medical records to support your claim. We’ll also discuss common reasons for claim denials and strategies for appealing them.

Typical Claim Filing Steps

The insurance claim process typically involves several key steps, each playing a vital role in ensuring your claim is processed efficiently and accurately. Understanding these steps will help you prepare and stay informed throughout the process.

- Pre-authorization: Many insurance plans require pre-authorization for certain PCOS-related treatments. This step involves contacting your insurance provider to confirm coverage for specific procedures or medications. This ensures that the chosen treatment is within the plan’s guidelines and that you won’t face unexpected costs.

- Gathering Documentation: Before submitting your claim, gather all necessary medical records, including medical history, diagnostic reports, test results (like blood work, ultrasounds), and any correspondence with your healthcare provider. This thorough documentation is essential for supporting your claim.

- Submitting the Claim: Once pre-authorization is obtained and documentation is complete, you can submit your claim form. The form should include all required details, like dates of service, treatment descriptions, and physician information. This step involves filling out the specific forms your insurance company requires, meticulously ensuring accuracy and completeness.

- Follow-up and Review: After submitting your claim, keep in touch with your insurance provider. Check for updates on the status of your claim, and don’t hesitate to inquire if you have any questions. The insurance company may request further clarification or additional documentation. Following up helps ensure the claim is processed promptly and efficiently.

Essential Documentation for Claims

A well-documented claim significantly increases your chances of success. Comprehensive records provide clear evidence of the services rendered and the need for treatment. The importance of maintaining a detailed medical history cannot be overstated.

- Medical Records: Detailed medical records are crucial. These records should include all diagnoses, treatments, medications, and test results related to your PCOS and its associated conditions. Ensure your records include dates, descriptions of procedures, and the names of the healthcare providers involved.

- Prescription Information: Include copies of prescriptions for medications related to PCOS treatment. Details like dosage, frequency, and start/end dates are important for claim processing.

- Diagnostic Reports: Gather copies of all diagnostic reports, such as blood test results, ultrasound reports, and pathology reports. These reports provide objective evidence of your condition and its severity.

- Pre-authorization Letter: If applicable, keep a copy of the pre-authorization letter confirming your insurance coverage for the planned procedures.

Common Reasons for Claim Denials and Appeals

Understanding the common reasons for claim denials can help you avoid these issues. Furthermore, knowing how to appeal a denied claim can increase your chances of receiving the necessary coverage.

- Incomplete Documentation: A common reason for claim denial is incomplete or inaccurate documentation. Ensure all required information is included and that the documentation accurately reflects the services provided.

- Lack of Medical Necessity: Insurance companies may deny claims if they believe the treatment or procedure is not medically necessary. Providing comprehensive documentation demonstrating the medical necessity of the care is crucial.

- Incorrect Coding: Inaccurate coding of procedures or diagnoses can lead to claim denials. Ensure that the codes used on your claim forms are correct and accurately reflect the services provided.

- Appealing Denials: If your claim is denied, carefully review the denial letter and understand the reasons. Follow your insurance company’s appeal process and provide supporting documentation to strengthen your case.

Illustrative Case Studies and Scenarios

Understanding how insurance policies handle PCOS-related care can be tricky, especially when navigating the nuances of medical documentation and claims processes. It’s like trying to fit a complex puzzle together, with each piece representing a different aspect of the condition and the insurance coverage. Here are some real-life scenarios to illustrate the complexities involved.Case studies are powerful tools, providing concrete examples of how insurance policies can impact individuals living with PCOS.

These examples highlight both successful claims and those that faced challenges, offering valuable insights for those seeking coverage for their PCOS-related needs. Hopefully, these illustrations will help shed light on the intricacies of PCOS insurance coverage.

Case Study 1: A Successful Claim

A young woman, Siti, experienced severe PCOS symptoms impacting her daily life. She sought treatment from a specialist, meticulously documenting her symptoms, diagnoses, and the prescribed medications. Her insurance policy covered a significant portion of the specialist’s consultations, medication costs, and diagnostic tests. This positive experience underscores the importance of meticulous record-keeping and choosing a healthcare provider who can clearly document the PCOS-related needs.

Case Study 2: Denial and Appeal

Pak Budi, a man with PCOS, experienced a denial of his claim for a PCOS-related surgical procedure. His insurance company cited insufficient evidence linking the procedure to his PCOS diagnosis. He appealed the decision, providing detailed medical records from his specialist, including the diagnosis, supporting documentation, and a clear statement of how the procedure addressed his PCOS-related complications.

While insurance coverage for continuous glucose monitors (CGMs) related to PCOS is a complex issue, it’s often tied to pre-existing conditions. Securing comprehensive travel insurance, particularly for those over 80, becomes crucial for unexpected medical expenses. Finding cheap travel insurance for the over 80s with robust coverage for chronic conditions like PCOS and potential CGM needs is key to ensuring a smooth and worry-free trip.

Ultimately, the answer to whether insurance covers CGM use for PCOS hinges on the specific policy details and the insurer’s interpretation of the condition.

His appeal was successful, demonstrating the crucial role of strong documentation and a skilled advocate in navigating such challenges.

Case Study 3: The Complexity of Coverage

The case of Ibu Nur illustrates the complexities of PCOS insurance coverage. Ibu Nur sought treatment for both PCOS and its related complications, such as insulin resistance. Her insurance policy covered some aspects of PCOS-related care, but not all. The coverage for the treatment of insulin resistance was dependent on specific diagnostic criteria and a comprehensive medical report.

This case highlights how the insurance coverage for PCOS might vary, depending on the specific procedures or complications arising from the condition.

Case Study 4: Successful Appeals for PCOS-Related Care

Numerous successful appeals for PCOS-related care have demonstrated that thorough documentation, a clear understanding of the policy terms, and a strong advocate can significantly improve chances of approval. Examples include instances where individuals provided detailed medical records, specialist letters explaining the connection between the treatment and PCOS, and documented the impact of PCOS on their daily life. Such cases emphasize the importance of collaborating with healthcare professionals and insurance providers to ensure the best possible outcomes.

Comparing Coverage Across Different Insurance Types

Salam sejahtera, dear readers! Understanding how different insurance plans handle PCOS-related care is crucial for effective management. This section will illuminate the variations in coverage among health plans, supplemental policies, and employer-sponsored versus individual plans. We’ll also explore the impact of financial aspects like deductibles, co-pays, and co-insurance, and the role of pre-authorization procedures.Insurance coverage for PCOS, like many medical conditions, isn’t uniform across all policies.

The specifics depend heavily on the type of plan, the provider network, and the individual policy’s terms and conditions. It’s essential to carefully review your policy documents to fully grasp your coverage.

Comparison of Health and Supplemental Insurance

Health insurance policies typically encompass a broader range of medical expenses, including those associated with PCOS diagnosis and treatment. Supplemental policies, on the other hand, often focus on specific needs, such as mental health services, fertility treatments, or specific medical equipment. They may provide additional coverage beyond the basic health plan, but may have limitations.

Differences in Employer-Sponsored and Individual Plans

Employer-sponsored health plans often offer more comprehensive coverage due to negotiating bulk rates with providers. Individual plans, however, might provide similar coverage but at a higher premium. Negotiated rates and plan design influence the overall cost of care. The benefits and deductibles vary widely between these two types of plans.

Impact of Deductibles, Co-pays, and Co-insurance

Deductibles, co-pays, and co-insurance significantly influence the out-of-pocket costs associated with PCOS-related expenses. A deductible is the amount you must pay out-of-pocket before your insurance starts to cover expenses. A co-pay is a fixed amount you pay for each visit or service. Co-insurance is a percentage of the cost of a medical service that you are responsible for paying.

Navigating insurance coverage for continuous glucose monitors (CGMs) for PCOS can be tricky. While some insurance plans might cover CGMs for managing specific conditions, it’s often dependent on the individual plan and the necessity of the device for health management. For a tasty and satisfying meal, you could always check out Vito’s New York Pizza & Restaurant Spring City PA vito’s new york pizza & restaurant spring city pa , but ultimately, contacting your insurance provider directly is the best way to understand your specific coverage for a CGM.

Ultimately, understanding your specific insurance plan details is key to securing necessary coverage for a CGM for PCOS.

These factors can greatly impact your financial burden. For example, a high deductible plan might require significant upfront payment before coverage kicks in, potentially delaying necessary treatment.

Role of Pre-authorization in Different Insurance Scenarios

Pre-authorization is a crucial aspect of insurance coverage. It’s a process where your insurance provider reviews and approves a proposed medical treatment or procedure before it’s performed. This is often required for certain treatments or medications. Understanding your insurance’s pre-authorization requirements and procedures is vital. Without pre-authorization, you might face delays in treatment or the possibility of unpaid medical bills.

Some insurance plans may require pre-authorization for all PCOS-related treatments, while others might have specific requirements for specific procedures.

Examples of Insurance Plans Offering Superior Coverage

Several insurance plans offer robust coverage for PCOS-related conditions. These plans may include specific coverage for diagnostic tests, fertility treatments, mental health services, or medications. However, specific plan designs and benefits can vary significantly. Checking with your insurance provider for detailed information about the specific benefits of your plan is essential. Examples of plans with potential superior coverage include those with extensive provider networks, lower deductibles, and inclusive co-pays for PCOS-related care.

Tips and Strategies for Navigating Insurance

Salamat, dear readers! Navigating the complexities of insurance, especially when dealing with a condition like PCOS, can feel overwhelming. This section offers practical strategies to help you secure better coverage and effectively manage claims. Let’s work together to make this process a bit smoother.

Strategies for Obtaining Better PCOS-Related Coverage

Understanding your insurance options is key. Research various plans and identify those that prioritize comprehensive coverage for PCOS-related treatments. This often involves examining the plan’s formulary, which lists covered medications and procedures. Some plans may even offer specific benefits for chronic conditions like PCOS.

Recommendations for Choosing Insurance Plans

Carefully review the details of each plan. Look for plans that include a wide range of coverage for diagnostic testing, hormone therapy, and other treatments for PCOS. Check if they offer telehealth options or have a network of specialists experienced in PCOS management. Consider factors like out-of-pocket costs, deductibles, and co-pays. A comprehensive plan with a lower out-of-pocket maximum can save you money in the long run.

Strategies for Effectively Communicating with Insurance Providers

Clear and concise communication is vital. When contacting your insurance provider, always maintain a polite and professional demeanor. Provide all necessary documentation, including medical records and physician recommendations, to support your claims. Clearly explain the specific treatments needed for PCOS management and why they are medically necessary. Keeping detailed records of all communications with the insurance provider will help you stay organized and track the progress of your claim.

This includes emails, phone calls, and any correspondence you receive.

Preparing for Potential Insurance Claim Denials

Unfortunately, claim denials can happen. Having a well-prepared strategy can help mitigate the impact. Gather all relevant medical documentation, including letters from your healthcare provider explaining the need for the treatment, and maintain copies of all communication with the insurance company. Review your policy carefully to understand the grounds for appeal. A thorough understanding of your rights and the appeal process can help you effectively navigate this challenge.

Methods for Researching Insurance Options

Conduct thorough research to identify insurance plans that provide comprehensive coverage for PCOS-related care. Utilize online resources like the health insurance marketplaces and compare plans based on their benefits and coverage. Check reviews and testimonials from other policyholders to gain insight into their experiences. Consider consulting with a financial advisor or a health insurance specialist to help you understand the nuances of various plans and make informed decisions.

This can save you time and potentially reduce the financial burden of navigating the complexities of insurance plans.

Outcome Summary

In conclusion, determining whether insurance will cover CGM for PCOS involves a multifaceted approach. Understanding your specific policy, the medical necessity of the CGM, and the intricacies of the claim process are crucial steps. By thoroughly researching your options, preparing necessary documentation, and potentially seeking expert advice, you can navigate the complexities and increase your chances of securing coverage for this essential medical technology.

Ultimately, the decision rests on a careful assessment of individual circumstances and available resources.

Query Resolution

Will my insurance cover the cost of a CGM if I have PCOS?

Insurance coverage for CGMs, like any medical device, depends on the specific policy and whether the CGM is deemed medically necessary for managing your PCOS and its associated conditions. Pre-authorization is often required. Contact your insurance provider for clarification.

What documentation do I need to submit with my insurance claim for a CGM?

You’ll likely need medical records, a prescription from your physician, and any pre-authorization forms required by your insurance company. Thorough documentation is key to a successful claim.

What are some common reasons for insurance claim denials for CGM use in PCOS cases?

Common reasons for denial include lack of medical necessity, inadequate documentation, or the CGM not being deemed a covered benefit under the specific policy. Review your policy’s details and consult with your doctor to address any potential issues.

What types of insurance policies are more likely to cover CGM use for PCOS?

Policies with broader coverage for diabetic-related conditions, or those specifically including PCOS-related treatments, may be more likely to cover CGMs. However, always verify directly with your insurance provider.